accumulated earnings tax irs

The accumulated earnings tax AET was put in place to prevent corporations from doing just that. Publication 542 012019 Corporations - IRS tax forms.

Form 5471 Schedule J Accumulated Earnings Profits E P Of Controlled Foreign Corporation Youtube

On whether the Commissions treatment of Taxpayers Accumulated Deferred Income.

. The tax rate on accumulated earnings is 20 the maximum rate at which they would. To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys corporate tax.

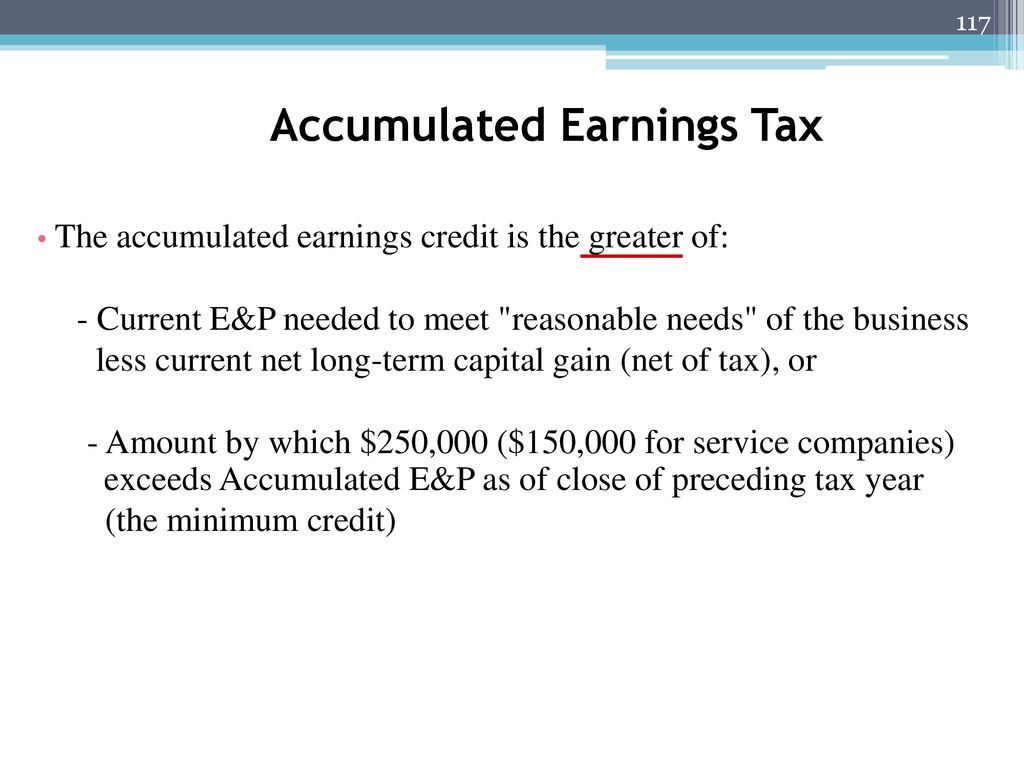

Accumulated Earnings Tax Accumulated Taxable Income 20 Personal Holding Company Tax In times past the tax rate on individuals was considerably higher than. 1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or Schedule M-3. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and profits to.

If the IRS finds that a corporation is accumulating income for the purpose of. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. The purpose of the tax The purpose of accumulated earning tax is to discourage the accumulation of profits if the purpose of such accumulation is to enable shareholders to avoid.

Internal Revenue Service Department of the Treasury Washington DC 20224. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. In January you use the worksheet in the Form 5452 instructions to figure your corporations current year earnings.

Its employee-owners substantially perform the services in 1 above. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the.

If you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year and the trust paid taxes on that income you must complete Form. Accumulated Earnings Tax IRC 531 The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable. It compensates for taxes which.

Recently the Tax Court had an opportunity to consider the. The tax rate on accumulated taxable income currently stands at 20 and fortunately the American Taxpayer Relief Act ATRA kept it from rising to a much higher scheduled rate of. The accumulated earnings tax can be a hidden penalty tax on highly profitable corporations that allow their earnings to accumulate without paying adequate or any.

This requirement is met if more than 20 of the. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. The last day of the calendar year in which its tax year begins.

Section 7702 Of The Irs Code A Little Known Opportunity For Business Owners Executives And Key People Maple Business Council

Irs Use Of Accumulated Earnings Tax May Increase

Form 5471 Top 6 Reporting Challenges Expat Tax Professionals

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Corporate Tax Copyright Ppt Download

Demystifying Irc Section 965 Math The Cpa Journal

Corporate Tax Copyright Ppt Download

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Are Retained Earnings Taxed For Small Businesses

Earnings And Profits Computation Case Study

Simple Strategies For Avoiding Accumulated Earnings Tax Tax Professionals Member Article By Mytaxdog

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm